Why Manhattan Office Leases Are Getting Smaller and Flexible in 2025

📌 What’s Happening?

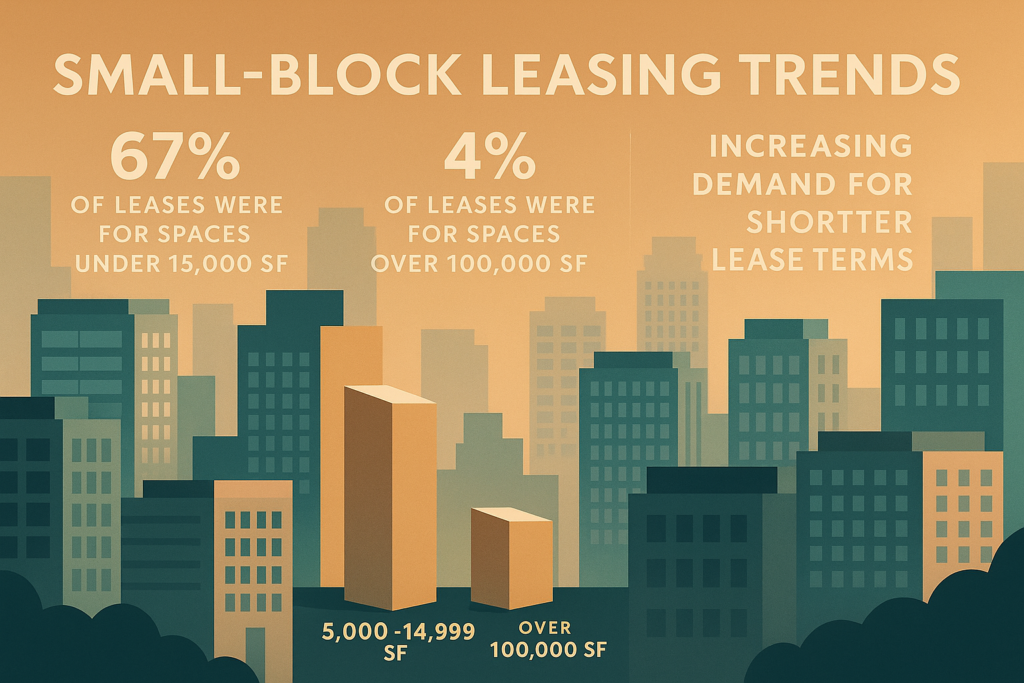

Office Leases Are Getting Smaller and Flexible even though leasing volume is surging—20.6 million sq ft in H1 2025, the strongest midyear since 2014—most of it comprises smaller office deals. About 67% of all leases in Q1 were for 5,000–14,999 sq ft, and the city is on pace for more than 1,200 such leases by year-end. While large lease signings make headlines, the bulk of tenant activity is increasingly small-scale, flexible, and adaptive.

Smaller, Flexible Office Leases Are Reshaping Manhattan’s Market

As the Manhattan office market evolves, a defining trend is the growing popularity of smaller office leases—particularly those between 5,000 and 15,000 square feet. More companies are choosing modest-sized footprints over expansive traditional layouts. This shift reflects a broader demand for flexibility, driven by a mix of post-pandemic work culture, budget-conscious decision-making, and the uncertain trajectory of future growth.

The appeal of these smaller leases lies in their adaptability. Businesses are increasingly pursuing short-term agreements that offer them room to pivot as circumstances change. Shorter lease terms not only provide agility in a volatile market but also reduce the long-term commitments that can hinder emerging or transitional firms. These arrangements are particularly attractive in an environment where hybrid and remote work have permanently altered how office space is used.

Cost-effectiveness is another major factor. Downsizing from a traditional multi-floor lease into a smaller, well-located office can significantly reduce overhead. Companies looking to optimize their resources—especially startups or those adjusting to workforce changes due to AI adoption—see smaller leases as a strategic advantage. Supporting this, 2025 has already seen a record number of small-block leases signed, reinforcing that demand for compact, flexible space is rising across all sectors.

🕰️ When Did This Start?

- Early 2025: Q1 saw 303 small leases—up from 954 total in all of 2024.

- Mid‑2025: Colliers projects full-year leasing at around 41 million sq ft if this momentum continues.

🌆 Where Is This Trend Most Visible?

- Across Manhattan—Midtown, SoHo, Downtown—but most noticeable in Class B and C buildings.

- Class A is also shrinking: lack of fresh large blocks means even top-tier tenants are taking smaller footprints.

👥 Who Is Driving These Smaller Deals?

- Small & mid-size firms, particularly tech and AI startups, leasing 1,500–3,000 sq ft.

- Larger tenants, including Fortune 500s, downsizing their space in response to outsourcing and AI efficiencies.

- Class B/C tenants requiring flexibility amid economic uncertainty.

Key Considerations When Leasing Smaller Space

Choosing the right small office in Manhattan requires weighing several factors beyond square footage. Location remains paramount; tenants looking for value often turn to submarkets such as the Garment District, Financial District, or Midtown South, where rates tend to be more favorable than in Midtown East or the Plaza District.

The class of building can also influence both price and tenant experience. Class B and C properties often present more affordable alternatives to trophy towers, while still delivering quality infrastructure—especially when recently renovated. Lease structure matters too. Tenants should explore full-service gross, modified gross, or net lease options depending on operational needs and how expenses are allocated. And finally, budgeting for upfront costs like security deposits—which may range from three to twelve months of rent—is essential, along with factoring in utilities, furnishings, and shared amenity fees.

In short, Manhattan’s shifting office landscape is rewarding tenants who are nimble, strategic, and well-informed. Smaller, flexible leases are no longer the exception—they’re the new standard for smart office planning in 2025.

🤔 Why Are Leases Shrinking?

- Market Uncertainty & Economic Headwinds

Tariffs, AI disruption, global instability—many tenants no longer want to commit to large, long-term space. - AI & Outsourcing

Firms are reducing their physical footprint because tasks once handled in-office are now outsourced or automated . - Startups & Funded Small Firms

These businesses forecast uncertain growth, so short-term, smaller leases offer the needed flexibility. - Landlord Pressure & Concessions

With oversupply in B/C, landlords agree to smaller, shorter leases to fill space. Even Class A now sees smaller deals due to shrinking large-block availability.

🛠️ How Are Tenants Adapting?

- Shortened Lease Terms:

- Financial firms average 7.6-year terms

- Tech & AI average 5.3 years

- Pure AI startups average just 3.5 years

- Seeking Optionality:

Small tenants (<10k sq ft) prioritize future scalability or downsizing flexibility. - Efficient Space Selection:

Class B tenants move into smaller, more efficient footprints, sparking demand even in lesser-grade properties . - Landlords Accommodating:

Deals with 3-year terms—once unheard of—are now common in B/C buildings .

How to Find Small, Flexible Offices in NYC

Navigating this emerging landscape requires strategy. Tenants seeking smaller, adaptable office spaces can benefit from professional tenant representation. Brokers not only help identify space options, but also negotiate favorable lease terms and concessions that might otherwise be overlooked.

Online marketplaces like LoopNet, SquareFoot, and us “NewYorkOffices” do provide curated listings for smaller offices across various neighborhoods. Meanwhile, co-working spaces remain a popular solution for businesses needing turnkey setups with amenities like high-speed internet, meeting rooms, and front-desk services. Subleasing is another growing avenue, allowing tenants to secure prime space in Class A buildings at a discounted rate through flexible arrangements.

📊 Key Stats at a Glance

| Metric | Figure |

|---|---|

| H1 2025 Leasing Volume | 20.63M sq ft (↑42% YoY) |

| Small Leases (5k–15k sq ft) | 67% of all deals in Q1 |

| Projected Small Deals for 2025 | ~1,200+ |

| AI Firm Lease Term | Avg. 3.5 years |

🔍 Find the Right Office – On Your Terms

Whether you’re a startup in need of agility or an established firm looking to downsize, now’s the time to secure flexible space on your schedule as Office Leases Are Getting Smaller and Flexible!

We specialize in helping NYC tenants navigate short-term leases, growth-ready footprints, and Class B/C opportunities with built-in concessions.

👉 Book a free consultation with a tenant rep – no fees, no obligation.

Let us help you find the office space that fits your future, not someone else’s timeline.

Fill out our online form or give us a call today 📞 212-967-2061 — let’s find the office for your business.

Resources

Flexible Lease Options in Manhattan

Class B Office Space Opportunities in NYC

How Tenant Reps Negotiate on Your Behalf

Why Smaller Offices Make Sense in 2025

Cost-Saving Concessions in Office Leasing

Short-Term Pop-Up Office Listings

Compare Class A vs. Class B Office Buildings

AI and the Shrinking Office Footprint

Average Lease Term for NYC Tech Startups