Understanding Today’s Office Rent Prices

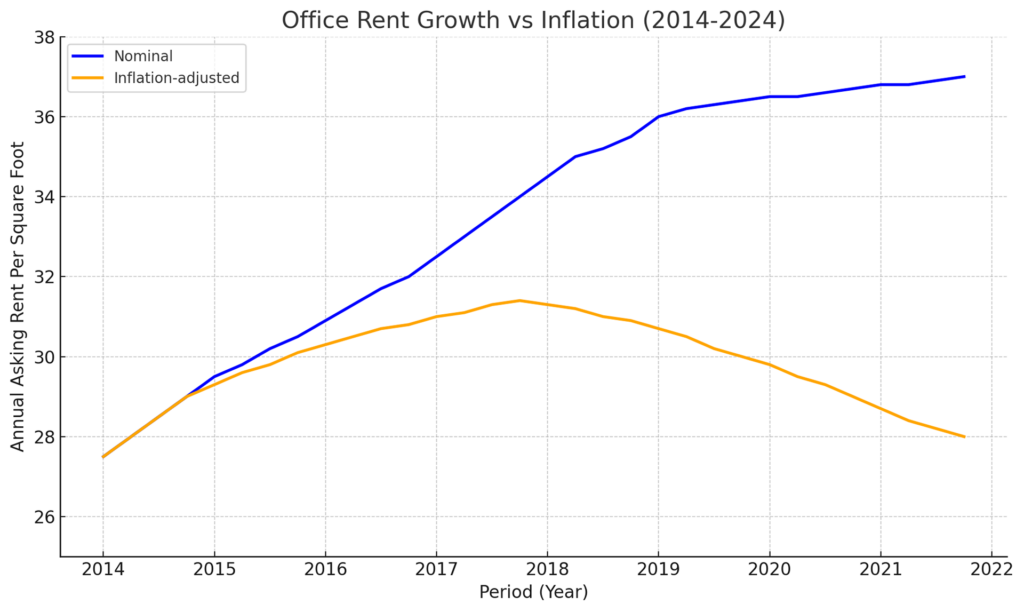

Understanding the Real Decline in Office Rents Despite Rising Asking Prices In recent years, commercial real estate observers have been puzzled by an apparent contradiction: asking rents for office space have risen, even as vacancy rates have soared. Several factors explain this seemingly counterintuitive trend, but a key aspect lies in the rapid inflation that peaked in 2022, which has outpaced the growth of office rents.

Since 2019, office rents have shown modest growth, with asking rents increasing nearly 2% by the end of the third quarter of 2024. This stabilization came after a brief dip in 2020, despite a historic rise in vacancy rates. However, this national trend doesn’t apply uniformly across all markets. Cities like Seattle have seen office rents fall by around 8%, and San Francisco experienced a sharp 30% decline. Still, in most U.S. markets, asking rents have held steady.

The Initial Price

It’s important to remember that asking rents represent the initial price landlords quote before negotiations, which is not necessarily reflective of the actual lease agreements. Equally significant is the macroeconomic environment, specifically the performance of office rents relative to overall inflation and other market conditions.

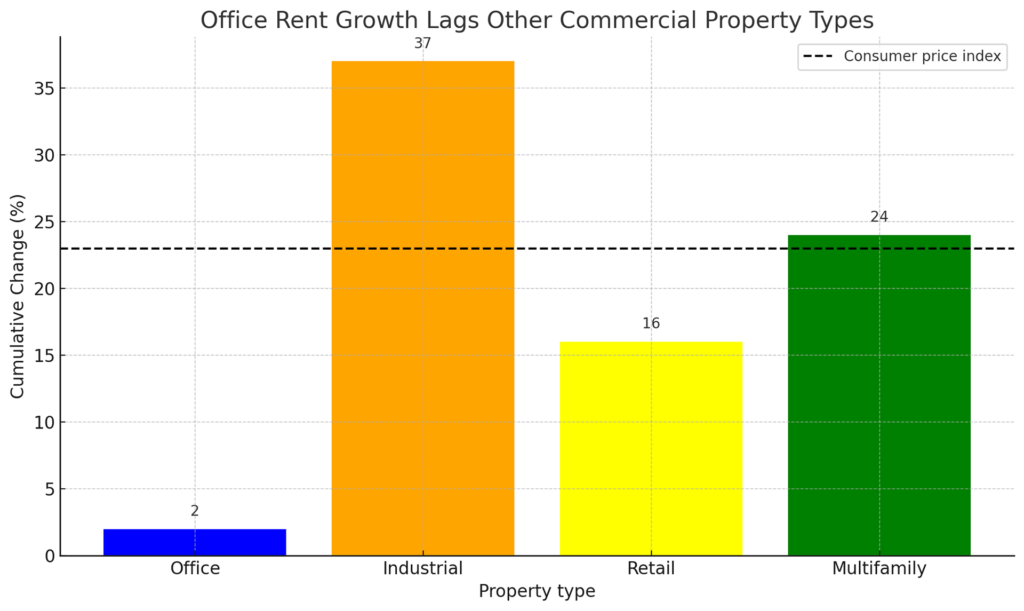

Inflation has been a dominant story in the past three years. Although consumer prices have stabilized recently, the consumer price index (CPI) is still 23% higher than at the end of 2019. While the CPI is not a perfect benchmark for commercial real estate, it does provide useful insights, as average rental rates tend to move in line with inflation over time.

The Percentages

In contrast to office space, other sectors of the commercial real estate market have performed much better. Industrial rents, for instance, have far outpaced inflation, growing 15 percentage points faster than consumer prices since 2019. This growth highlights why industrial real estate remains an attractive investment opportunity. Similarly, apartment rents saw a surge during the pandemic, with a nearly 10% increase in 2021 due to migration trends. Although multifamily rent growth has since slowed, overall apartment rents have still risen by almost 19%, approaching the CPI increase.

Retail rents, meanwhile, have risen about 16% since 2019, lagging behind inflation but still growing at a rate significantly higher than office rents.

So, why haven’t office rents plummeted in the face of high vacancies?

While asking rents have remained relatively stable, the reality is that office rents have declined in real terms. If office rents had kept pace with inflation, they would be more than 20% higher than they are today.

This decline in real rents offers a clearer perspective on the office market’s struggles, reflecting a sector still grappling with the aftermath of the pandemic and the widespread adoption of hybrid work models.

In conclusion, while office asking rents have stayed stable or even risen slightly, the real story is that inflation-adjusted rents have dropped significantly. This underlying decline helps explain why many office spaces remain underutilized despite seemingly robust asking prices, painting a more nuanced picture of the current state of the commercial office market.