Manhattan Office Market Sees Vacancy Decline and Leasing Surge in Q3 2024

The Manhattan office leasing market experienced a significant uptick in activity during the third quarter of 2024, according to a recent report from Avison Young. This surge has led to a noticeable decrease in vacancy rates and an increase in leasing, driven by a particularly active summer.

Leasing activity in Manhattan reached 23.1 million square feet in Q3 2024, representing a 25.1% increase compared to the same period last year. A key contributor to this rise was the completion of 25 transactions involving spaces larger than 100,000 square feet, up from just 18 in the third quarter of 2023.

For the first time since the first quarter of 2021, Manhattan’s office availability rate dropped below 19%, settling at 18.7% by the end of Q3. This decrease amounts to roughly 4.8 million square feet of available space, signaling a potential turning point for the city’s office market, which was severely impacted by the pandemic.

Rory Murphy, Avison Young’s New York City market leader, expressed optimism about the trend, stating, “The activity across the New York City market suggests that there is cause for confidence as we turn the corner and enter 2025. Although transactions are still taking longer to close compared to pre-pandemic times, there are indicators that this timeline may shorten after the upcoming election.”

Some of the quarter’s largest leasing agreements included Blackstone’s renewal and expansion for 1.06 million square feet at 345 Park Avenue, Christie’s Auction House renewing 406,719 square feet at 20 Rockefeller Plaza, and law firm Willkie Farr & Gallagher’s 313,086-square-foot deal at 787 Seventh Avenue.

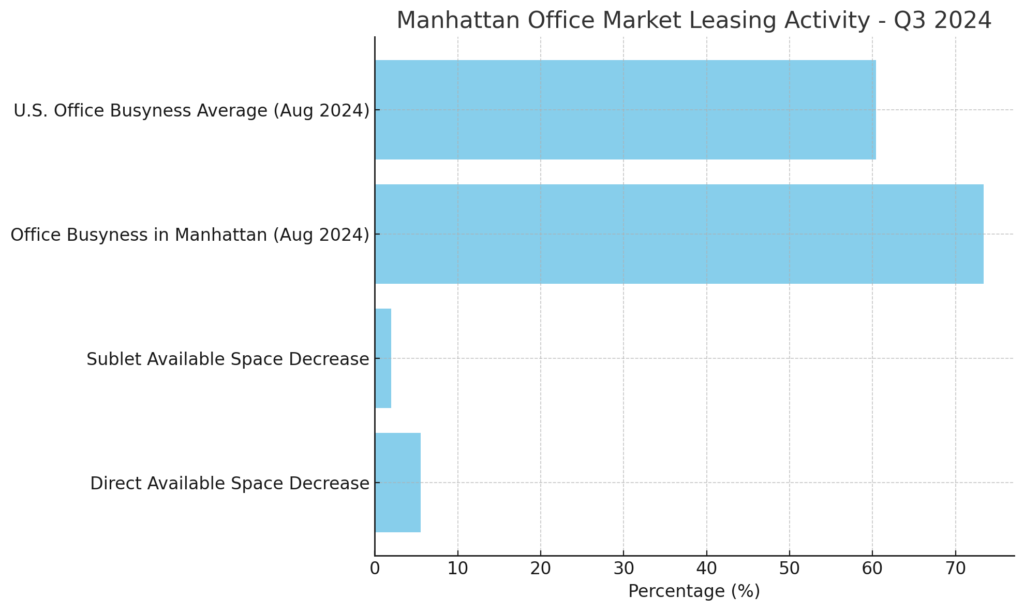

The report highlighted a notable decline in direct available space, which fell by 5.5% from the previous quarter — the largest quarterly drop in recent years. Sublet space availability also decreased by 2% during the same period.

Class A and Trophy spaces accounted for 76.3% of this year’s leasing activity, with most of the deals involving relocations or tenants moving into newly developed offices.

Along with rising leasing numbers, office occupancy levels have also improved. Manhattan offices were 73.4% as busy in August 2024 as they were in the same month in 2019, a substantial increase compared to the national office busyness average of 60.4%. Avison Young uses cellphone data to track office entries, and the report attributed this growth in office attendance to robust activity in the finance and government sectors, especially in areas like Midtown West and near Central Park.

However, the report also cautioned that upcoming lease expirations could challenge the market’s recovery. Between 2025 and 2030, major tenants in the banking, finance, insurance, and real estate sectors are set to see leases expire for 42.1 million square feet, which could slow the current momentum.

Despite these concerns, the third quarter was particularly strong, with a 19% increase in activity compared to the five-year quarterly average. The remainder of 2024 will determine whether this trend continues.